Business Insurance in and around Fort Oglethorpe

Get your Fort Oglethorpe business covered, right here!

Insure your business, intentionally

This Coverage Is Worth It.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes mishaps like a staff member getting hurt can happen on your business's property.

Get your Fort Oglethorpe business covered, right here!

Insure your business, intentionally

Small Business Insurance You Can Count On

With State Farm small business insurance, you can give yourself more protection! State Farm agent Lee Miller is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Lee Miller can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let fears about your business stress you out! Call or email State Farm agent Lee Miller today, and discover how you can save with State Farm small business insurance.

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

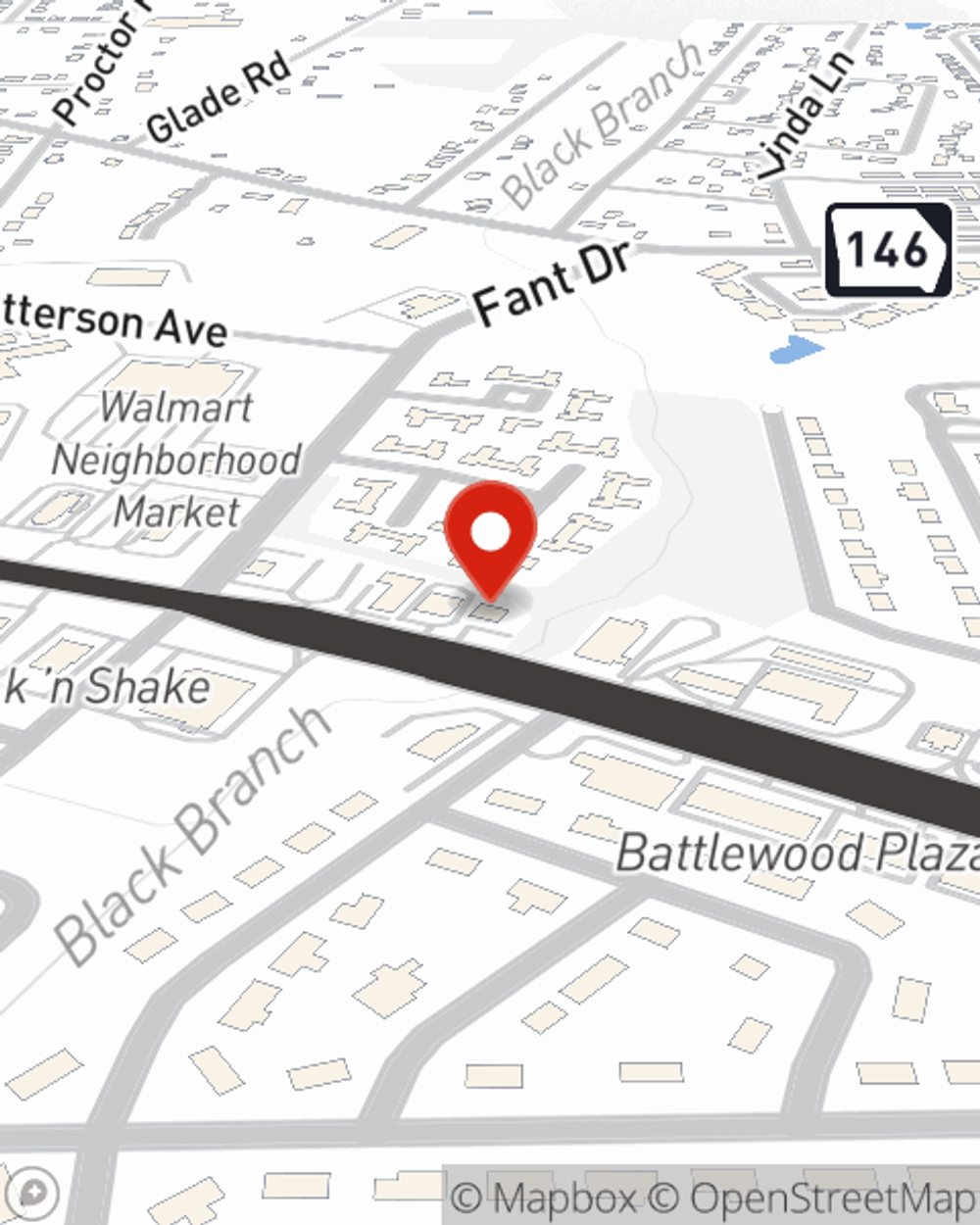

Lee Miller

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.